Finance

With regards to Nepal’s financial markets, IME Group is proud to be at the forefront of remittance, banking, digital finance, investment, and insurance.

IME Limited

IME Limited is a prominent player in the remittance sector of Nepal and has also set up a coveted global eminence. With over 150,000 global locations, the international network of IME Remit spans over 25 countries, including Malaysia, Qatar, the United Arab Emirates, Saudi Arabia, Japan, the United Kingdom, the United States, and India. IME Remit helped to institutionalize the remittance business in Nepal by establishing correspondent relationships with hundreds of global financial institutions. IME Remit provides world-class remittance services and owns a significant market share of the service. With 5400 franchise outlets, IME Remit has an extensive domestic network all over Nepal. The catchphrase “IME Garaun” (Let’s Do IME) has become a synonym of remittance or Money transfer. Actually, IME is the buzzword for every kind of money transfer in Nepal.

IME is the foremost remittance company in Nepal, renowned for its extensive global network with over 150,000 pay-out locations worldwide. IME was awarded the Large Tax Payer Award along with CIP Award for its substantial contributions to Nepal’s foreign currency reserves.

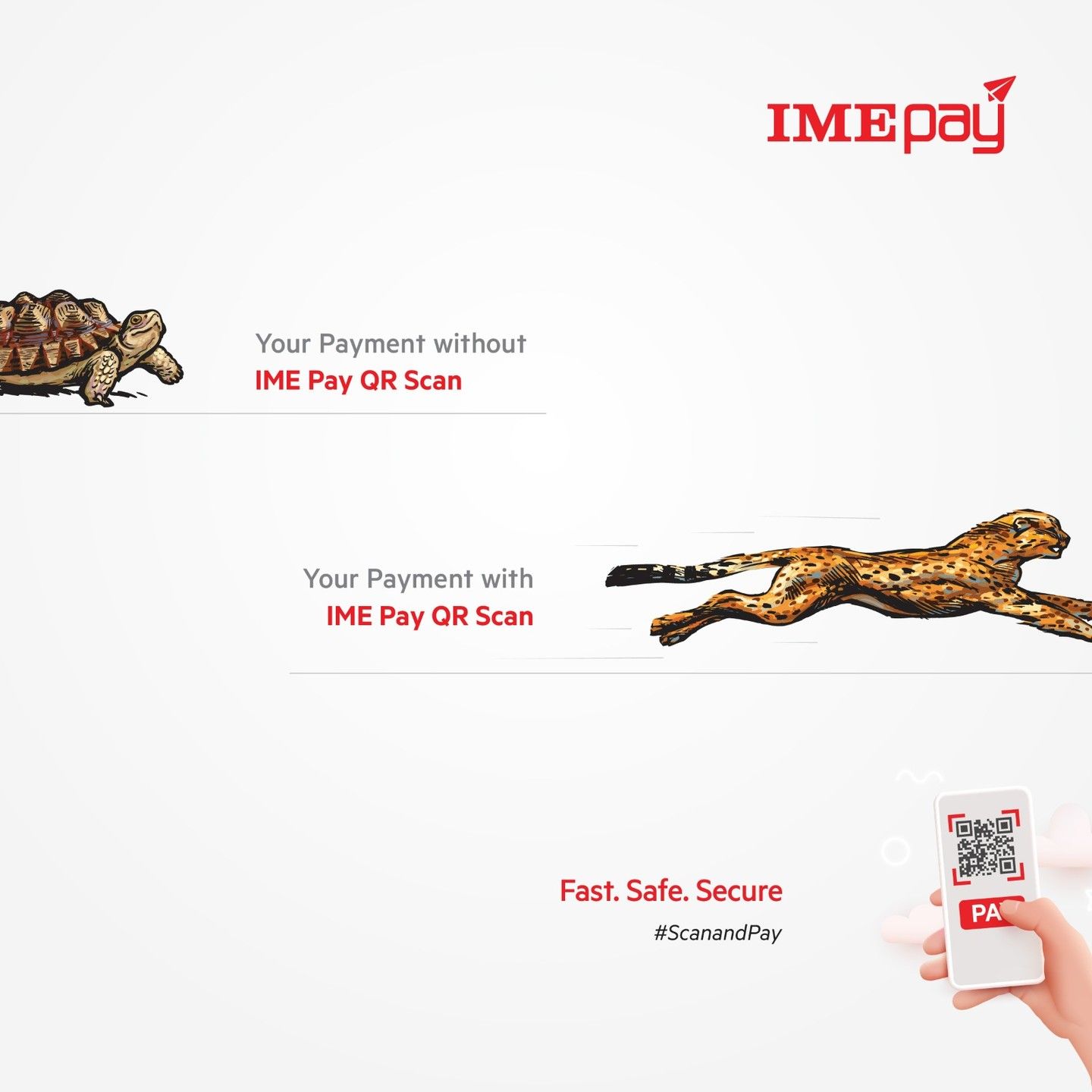

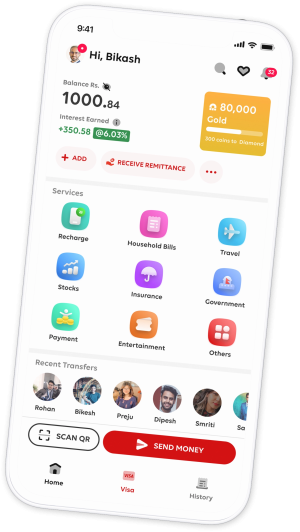

IME Digital Solution Ltd.

IME Digital Solutions Limited is a digital payment solution provider that offers a wide range of payment services and a convenient money transfer method. IME Pay is an easy-to-use platform for wallet-to-wallet transfers, utility bill payments, ticketing, checkout payment gateways, and more, aiming to digitise payments across Nepal.

IME Pay can be accessed from a mobile and serviced through any of the 25000 plus strong agent networks. Its goal is to serve Nepal’s great majority of banked, unbanked, and underbanked customers. It has received an international award as “AN OUTSTANDING USER ORGANIZATION from ASOCIO in 2021.”

IME Co-operative Service Ltd.

IME Cooperative was founded to provide and extend international-level financial services to people from all walks of life. It ensures its members’ long-term viability by offering financial independence, cooperation, and support for their joint economic interests, all while adhering to internationally recognized cooperative values and practices.

Global IME Bank is one of Nepal’s largest ‘A’ class commercial banks, boasting one of the country’s most extensive networks among private commercial banks. It was established in 2007 and currently operates with 354 branches, 369 ATMs, 322 branchless banking services, 64 revenue collection and extension counters, and 3 International Representative Offices. The bank expanded its presence with a representative office in Sydney-Australia, London-Uk and New Delhi- India. In addition to providing commercial services to its customers, the bank also manages government transactions.

Global Bank Limited (GBL) was established in 2007 as an ‘A’ class commercial bank in Nepal which provided entire commercial banking services. The bank was established with the largest capital base at the time with paid up capital of NPR 1.0 billion. The paid-up capital of the bank has since been increased to NPR 35.77 billion. The bank’s shares are publicly traded as an ‘A’ category company in the Nepal Stock Exchange.

It is in line with the aim of the bank to be “The Bank for All” by giving necessary impetus to the economy through world class banking service.

Global IME Capital Ltd.

Global IME Capital Limited (GICL), a subsidiary of Global IME Bank Limited, holds the distinction of being the first specialised merchant bank in the history of the Nepalese Capital Market. GICL is incorporated under the Nepalese Companies Act 2007 and has been granted a license by the Securities Board of Nepal to engage in Merchant Banking Activities under the Securities Act 2007. GICL offers a comprehensive range of services, including Issue Management, Registrar to Shares, Underwriting, and Portfolio Management Services. Additionally, it provides Asset Management, Depository Participant, and Corporate Advisory Services.

Nepal Infrastructure Bank Limited (NIFRA) was established with a vision to become the primary financial institution in the nation for infrastructure development. As Nepal’s first infrastructure development bank, NIFRA aims to bridge the infrastructure financing gap by mobilising resources from domestic and international markets. These resources take the form of equity, debt, structured funds, and bonds, which are then applied to economically viable infrastructure projects. NIFRA adopts proven models of infrastructure financing to achieve its mission.

Venture Hire Purchase Limited

Venture Hire Purchase Limited, incorporated in Nepal with Registration No. 167715/73/074, dated 2074.01.15, with its registered head office located at Panipokhari, Kathmandu is a leading Hire Purchase services institution licensed by Nepal Rastra Bank to conduct hire purchase transactions, as per License No. NRB/H.P./Other/08/076/77, dated 2076.08.03. Through Hire Purchase arrangements, it specializes in providing financial support for acquiring commercial vehicles, machinery, dozers, solar equipment, backhoe loaders, cranes, tractors, and other alternative energy products.